The wall between software platforms and financial services has crumbled. Five years ago this was theory. Today your fiercest competitors are launching branded credit cards and offering loans right inside their apps. The pace of this change is accelerating, quickly separating the platforms that can adapt from those that will be left behind.

The global embedded finance market is expected to grow from approximately $146 billion in 2025 to nearly $690 billion by 2030, at a 36% CAGR.

For businesses, this means a chance to create seamless experiences, unlock new revenue, and make your platform stickier than ever. But engineering leaders, this opportunity is welded to serious complexity. Architectural integration, compliance, and vendor risk are not just checklist items. They are high-stakes domains that can derail your roadmap and expose your company to significant liability.

This article cuts through the hype. We’ll break down how embedded finance works under the hood, what it takes to implement at scale, and how to make the right strategic bets for your organization.

Technical Foundation: How Embedded Finance Works

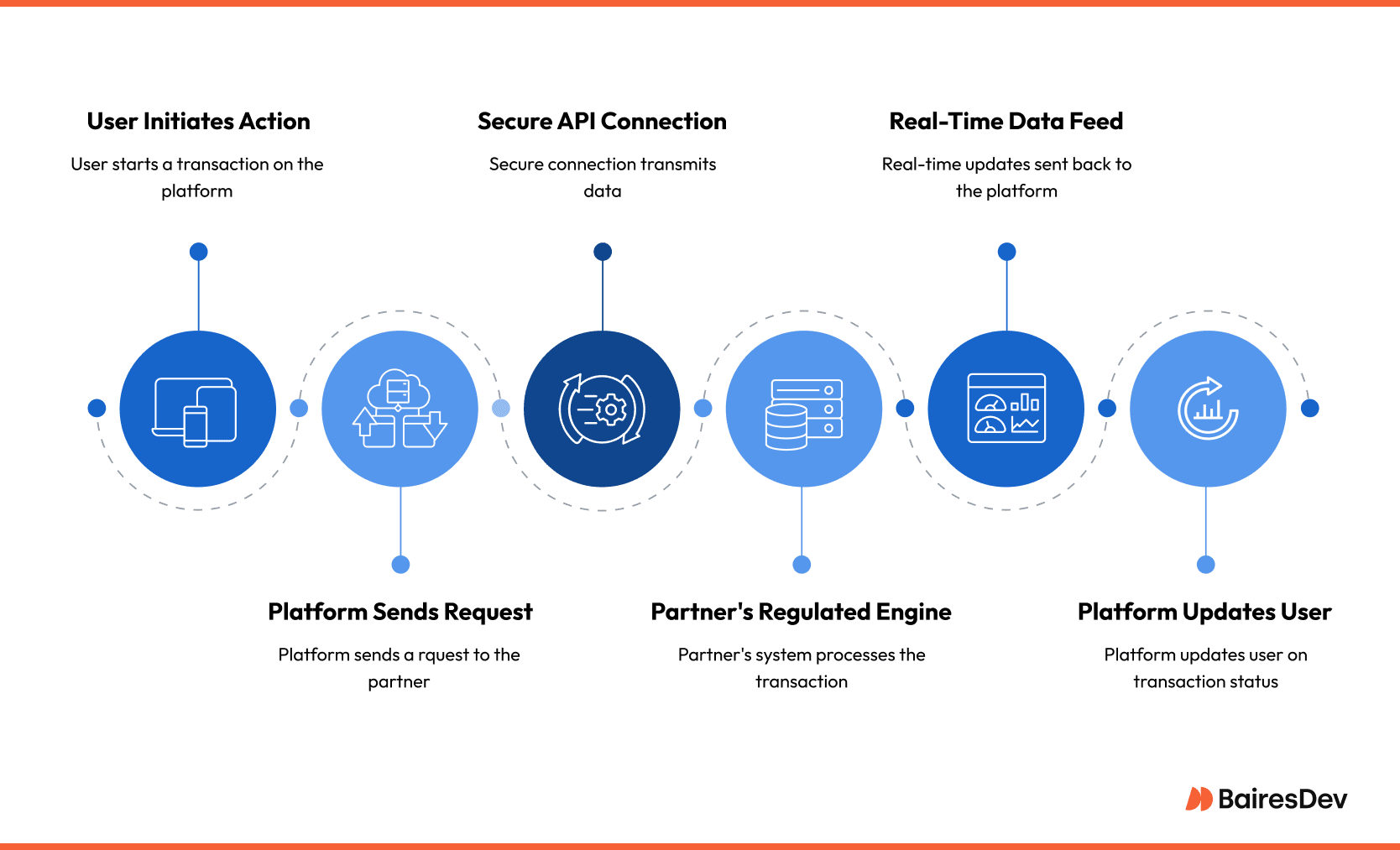

Embedded finance represents a powerful shift in how non financial platforms offer financial tools. At its core, the model depends on:

- Secure application programming interfaces (APIs)

- Banking as a service partnerships or licensed financial institutions

- Seamless UX integration

Licensed financial institutions or financial service providers provide backend infrastructure via APIs, including KYC/AML compliance workflows, account issuance, transfers, and card services. Your platform embeds this functionality in front-end workflows, enabling digital banking, embedded lending, embedded insurance, and more. Customers stay in your digital platform, with services powered by third-party embedded finance providers.

Typical architecture includes:

- API orchestration layer aggregating payment and banking APIs

- Identity and access management, multi-factor authentication

- Tokenization and encryption of financial data

- Event-driven architecture (e.g., Kafka or webhooks) for real-time updates

- API-based microservices for flexible integration

- Monitoring and observability for audit trails and tracing

- Rate-limiting, retries, and backoff logic for resilience across services

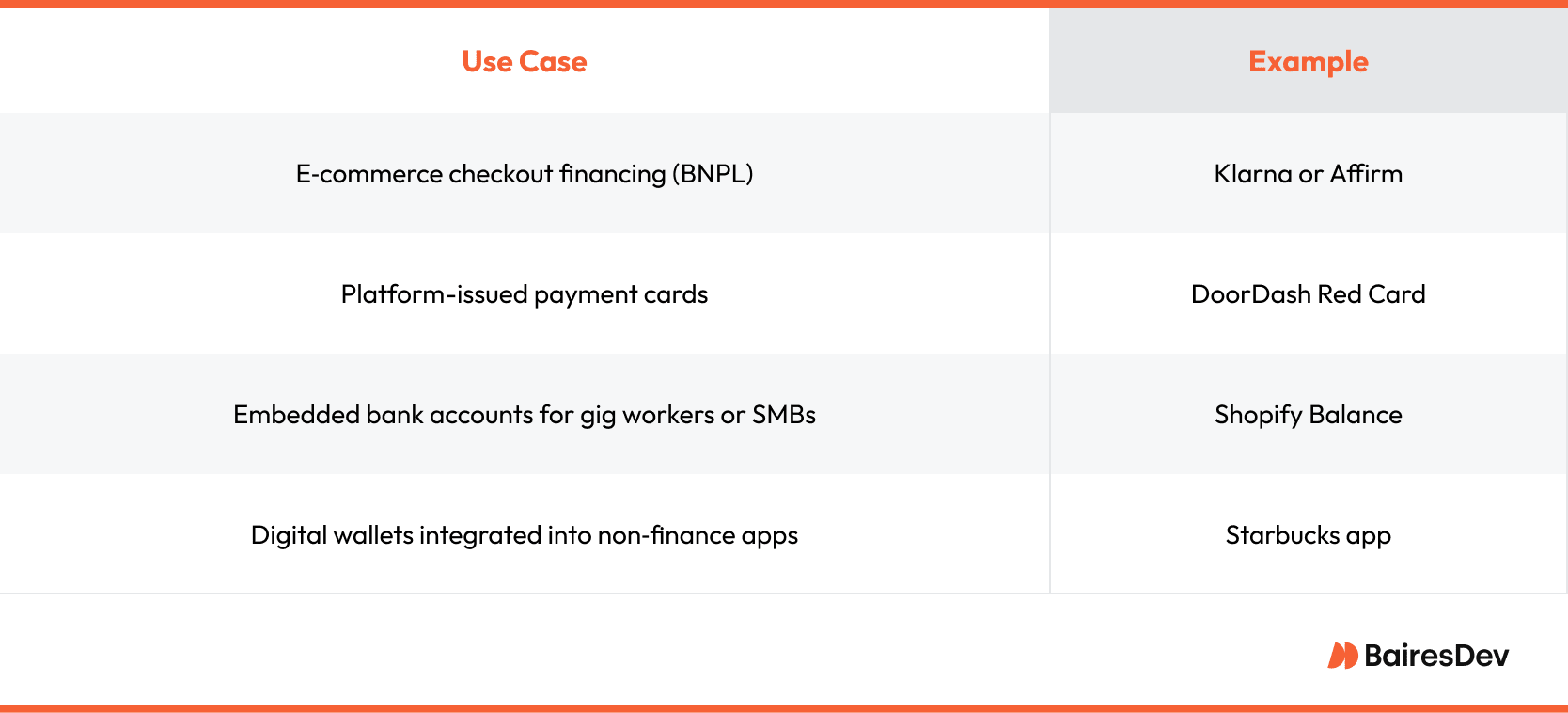

Common Use Cases

These represent embedded finance products, embedded banking accounts, debit cards, payment accounts, business management, payroll solutions, savings accounts, sales financing, bill pay, cash flow tools—all accessible within your product.

Implementation Timelines

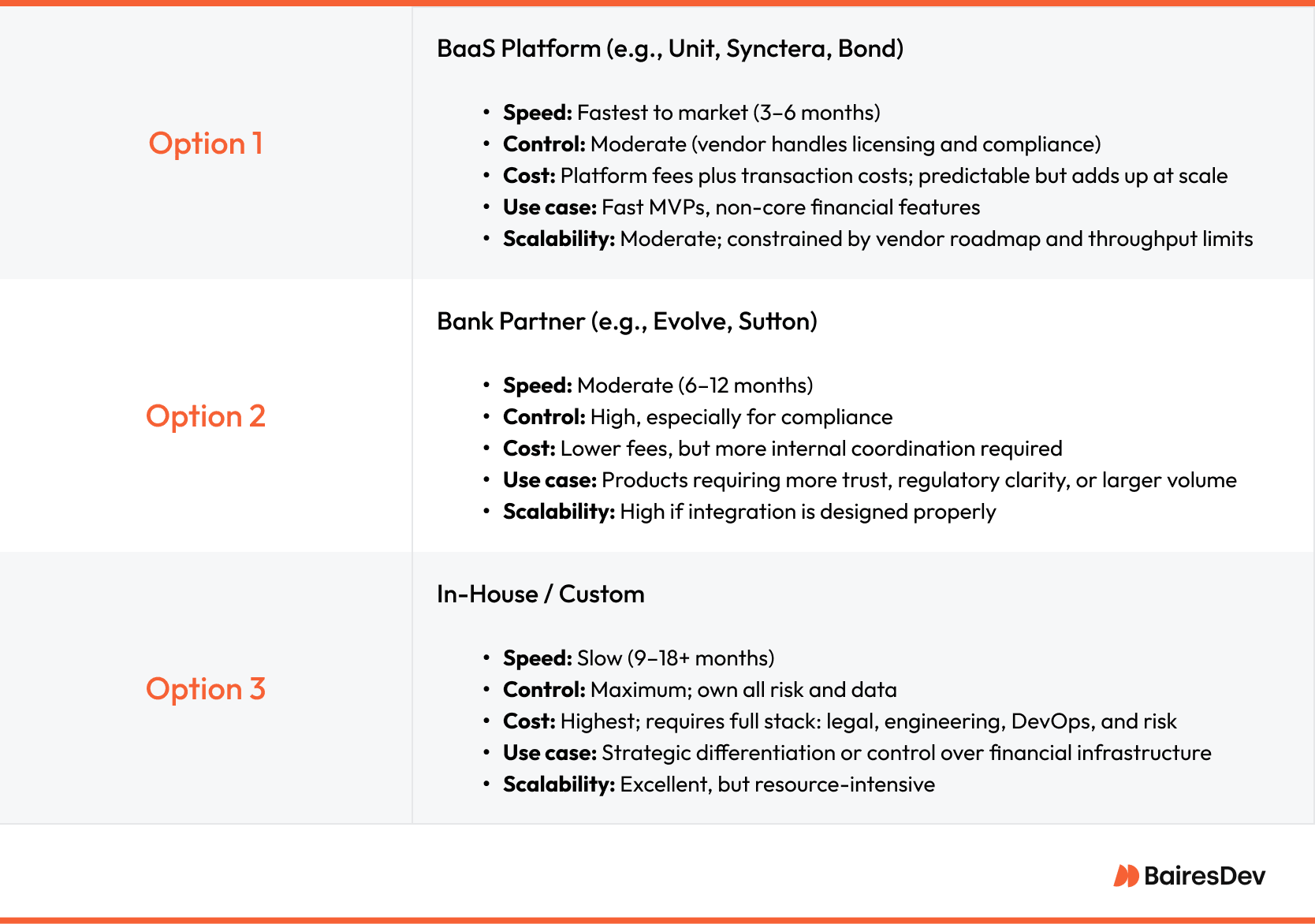

- BaaS provider: 3–6 months

- Bank partner: 6–9 months

- In-house build: 9-18+ months, with highest compliance demands

Your choice affects how quickly you can offer banking services, what level of control you have, and how you scale compliance.

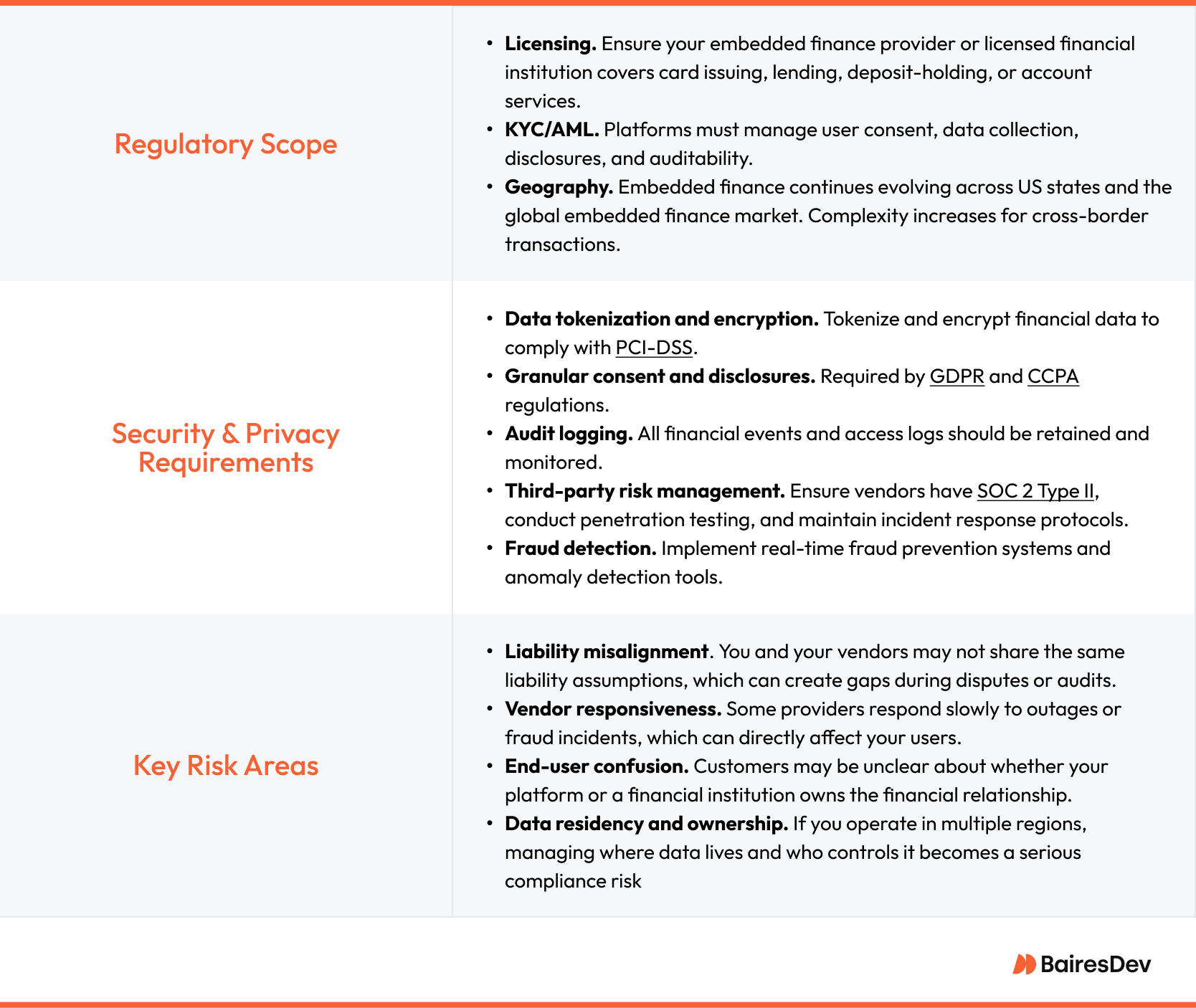

Compliance, Security, and Risk Management

As embedded finance continues to evolve, the role of traditional banks and financial institutions is shifting. Increasingly, financial services are being distributed by nonfinancial companies—platforms that control user engagement and transactional flows.

This transformation makes compliance and risk not just a regulatory obligation, but a strategic differentiator. If you’re embedding financial tools into your product, you’re stepping into a regulated domain. Getting this right protects your customers and preserves your ability to scale.

Embedding financial products opens regulatory and security exposure. Begin with:

Engage your legal, risk, product, and security teams before vendor selection. A strong foundation supports scaling and protects both platform and customer interests.

Monetization and Business Value

Embedded finance isn’t just an interface enhancement. It enables financial service providers to offer embedded finance offers such as:

- Interchange and transaction fees from branded credit card use

- Margin or interest from embedded lending, financing options, BNPL, invoice factoring

- Wallet float and retention through embedded insurance, payroll solutions and savings accounts

- Business models that combine commerce and business management with financial management

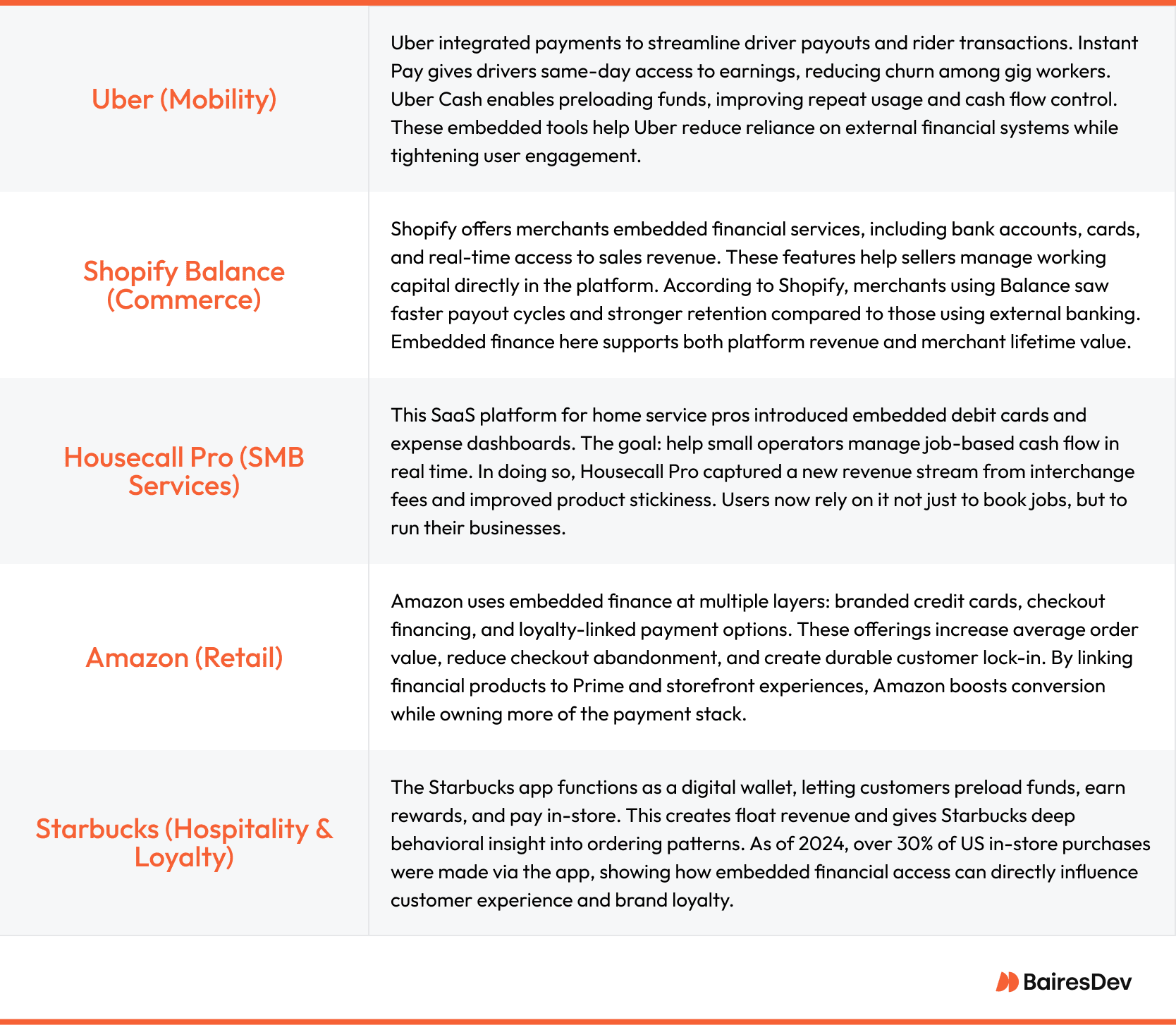

Companies like Shopify and Housecall Pro earn recurring revenue from embedded finance solutions by enabling wallet float revenue, financing options, and payment process control. Customers benefit from integrated financial access that ties them closer to your digital platform, creating stickiness and stronger relationships.

Integration Models: Vendor vs. Bank vs. Build

Each model offers different trade-offs in speed, control, and scalability:

Start with a platform or bank partner, then transition toward control as you scale compliance needs and volumes.

Decision Factors

- Time to market vs. control and regulatory appetite

- Global embedded finance market vs. domestic scope

- Internal bandwidth across engineering, compliance, and product

- Growth path: whether to expand from wallets and payments into lending, insurance, or bank accounts

Plan flexibility, for example, pilot embedded lending, then extend into embedded insurance or payroll solutions.

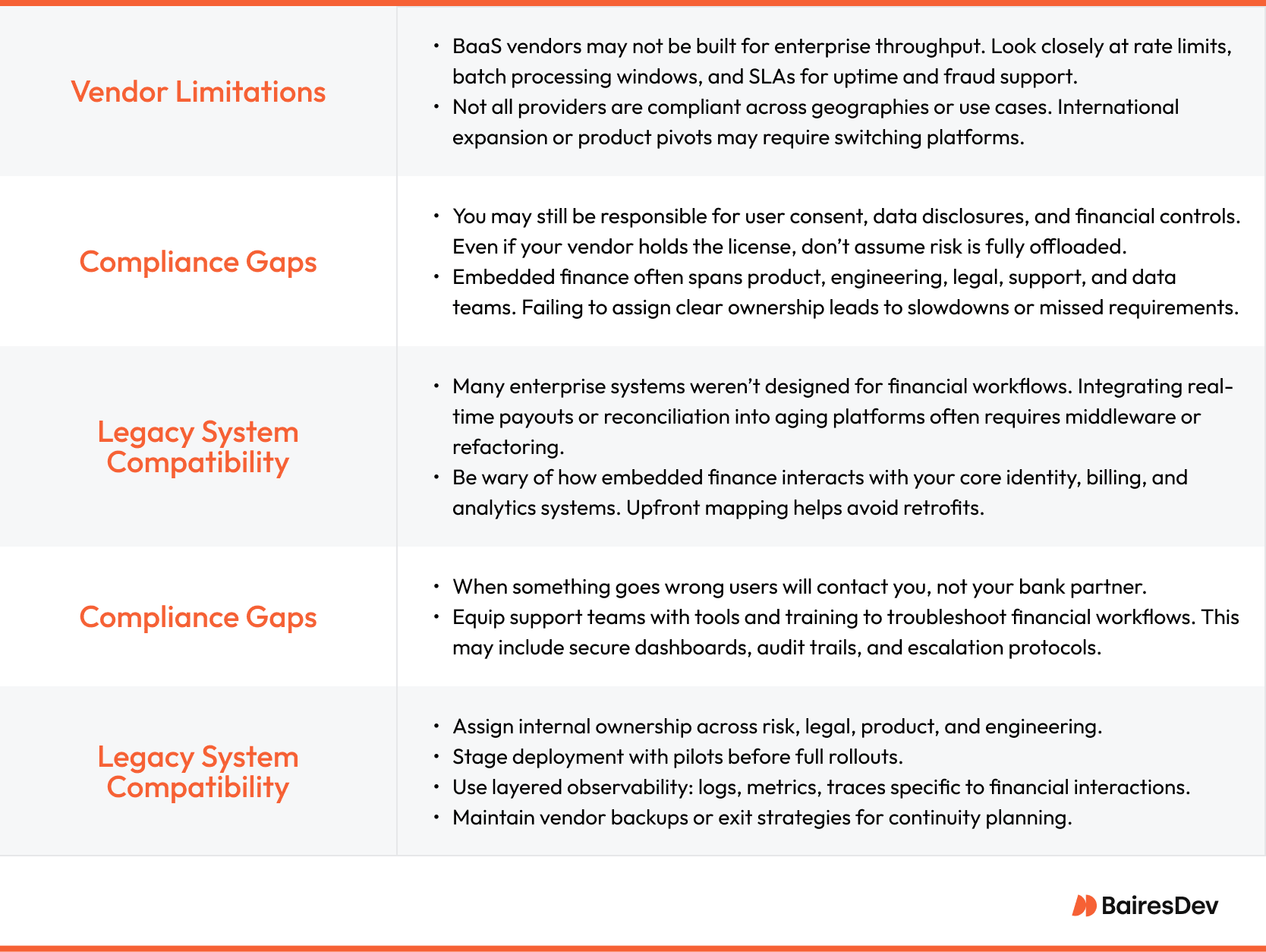

Operational Challenges and Mitigations

At scale, enterprise rollout of embedded finance products surfaces cross-functional complexity.

These challenges aren’t flaws in embedded finance. They’re signals that it’s becoming infrastructure. Success depends less on the vendor you choose and more on how well you integrate, govern, and support it internally. Treating financial workflows as part of your core system architecture—not an add-on—positions your platform for scale, stability, and long-term margin capture.

Case Examples from Real-World Adoption

This is no longer theoretical. Leading platforms across industries have already made it a strategic layer, embedding financial services to increase retention, expand revenue streams, and improve operational leverage. These examples show how embedded finance offers real-world business value across mobility, commerce, services, and consumer loyalty.

These are signals that embedded finance offers are becoming commonplace in platforms that handle money movement, merchant services, or transactional flows. Whether targeting gig workers, small businesses, or consumers, embedding financial tools directly into your product can deepen relationships, open new revenue paths, and increase platform defensibility.

The question isn’t whether embedded finance works—it’s how quickly you can implement it at enterprise scale.

Planning & Implementation: What to Expect

Implementing embedded finance isn’t a single team’s job. It typically involves coordinated work across product, engineering, legal, and risk. From initial exploration to production, most enterprises spend 2–3 months on vendor evaluations, regulatory reviews, and architecture planning before a single line of code is written.

Even if you work with a licensed provider or BaaS platform, your team is still responsible for key internal functions: securing user consent, managing financial data flows, and supporting embedded features operationally. You’ll likely need to build or extend identity integrations, webhook handling, error monitoring, and transaction dashboards, especially if customer support teams will be resolving financial issues.

Vendor reliability is critical. Prioritize providers with SOC 2 certification, documented SLAs, and experience supporting high-volume platforms. Include procurement, security, and compliance teams early in the review process. The earlier these reviews happen, the smoother your implementation will be.

Final Thought

Here is the ultimate takeaway. For decades, traditional financial institutions were the gatekeepers. This widespread financial transformation is tearing down those gates.

The real prize in this shift is owning your customer relationships on a much deeper level. You move beyond adding features and integrate your platform directly into the financial lives of your users. Thinking of this as a simple product decision is a critical error. It is a strategic mandate that will determine how your platform competes for the next decade.

Frequently Asked Questions

What are typical integration models for embedded finance?

API-first fintech platforms (e.g. Stripe Issuing, Railsr), bank-led BaaS providers, and in‑house integrations. Fintech gives speed; bank partners bring regulatory infrastructure; custom builds offer control at greater cost.

How are compliance and regulatory responsibilities divided?

Responsibilities vary by model. Fintech vendors and technology providers may carry license obligations (e.g. pre‑approval by financial regulators). With bank partners, financial companies often hold accountability for KYC/AML. You’re still accountable for user consent, data flows, and secure operations.

What are the main security and privacy controls to enforce?

Tokenize PII and financial data, implement end‑to‑end encrypted channels, enforce least‑privilege access, log all API calls, run regular SOC 2/PCI audits, and apply data retention minimization.

What are realistic timeframes and budgets for a pilot?

An MVP (payments or wallets) can launch within 3–4 months using an off‑the‑shelf BaaS provider, with platform fees plus transaction costs. Custom solutions typically need 6–12+ months and require infrastructure, legal, compliance, and DevOps investment.

How do you measure ROI?

Track onboarding conversion rate lift, checkout drop‑off rates, incremental average order value, fee revenue per user, and retention metrics. Customer case studies frequently cite 10–30% conversion lift, 5‑10% revenue lift, or 20‑40% reduction in churn.

How to choose between fintech/BaaS vendors?

Evaluate based on licensing gap coverage, SLAs, data accessibility, compliance support, integration flexibility, platform maturity, and ability to scale globally, or regionally if you have cross‑border needs.