Recessions and periods of diminished business activity are inevitable. During tough economic times, revenues shrink as consumer spending drops, and budgets tighten as organizations scale back. These effects often linger long after the economy’s recovery.

For enterprise technology leaders, navigating a recession demands more than cautious management. A more resilient approach focuses on operational stability, flexible capacity, and delivery agility. By building these as foundational strengths, tech leaders are better positioned to handle volatility and maintain organizational momentum in uncertain economic conditions. This proactive stance helps build a recession-proof business.

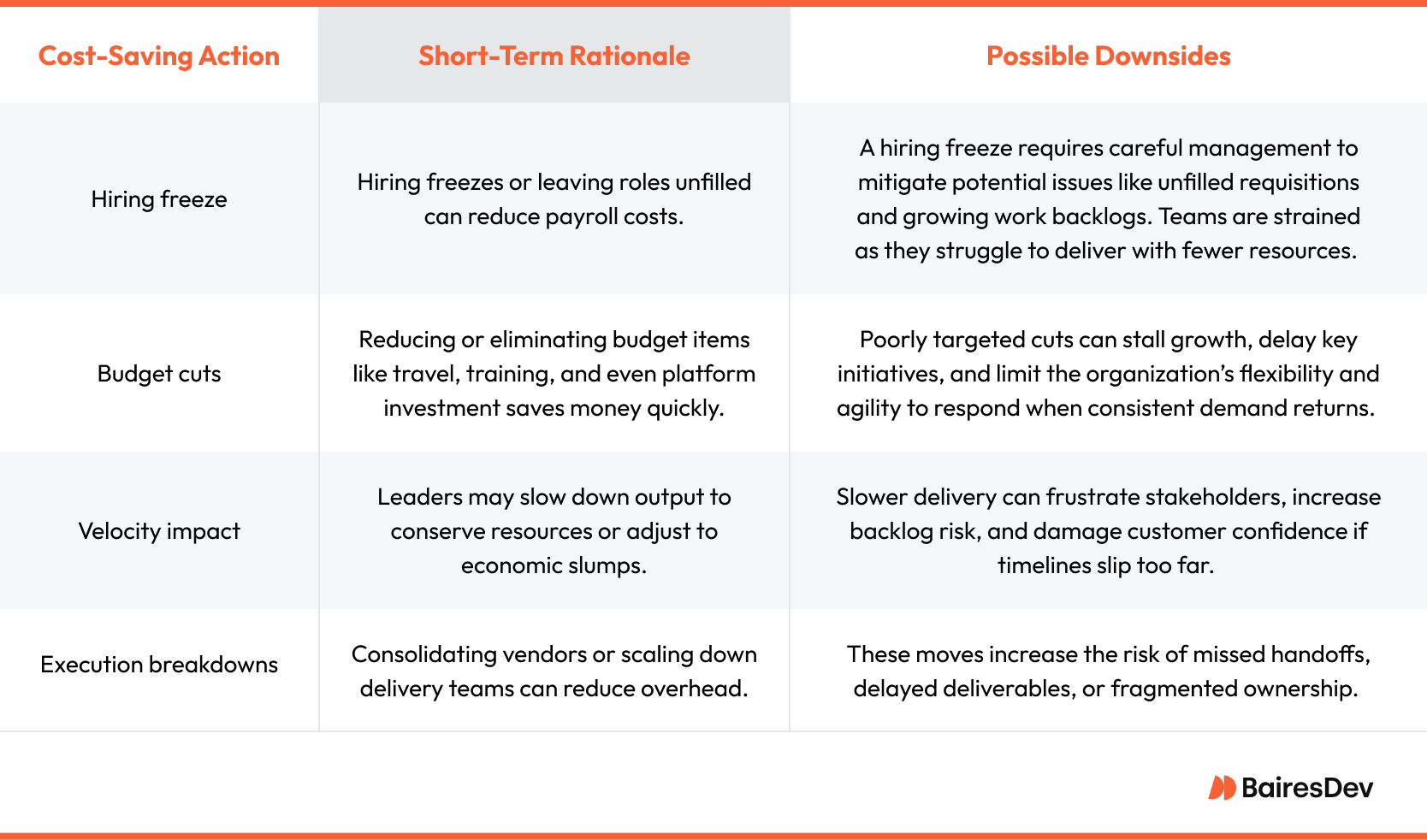

Risks That Arise from Common Cost-Saving Measures

Business leaders may respond to economic downturns by cutting budgets, hiring freezes, vendor changes, and other cost saving actions. It’s important to understand the long-term risks of these actions. To avoid downstream disruption, tech leaders need to identify and mitigate the unintended consequences they may cause.

Recession-Proofing Your Organization

Preparing for an economic recession isn’t just about cost cutting.

According to Deloitte, the US economy is expected to grow by just 1.4% in 2025 and 1.5% in 2026, pointing to a slow recovery and extended economic uncertainty. With global growth forecasted to slow to 2.9% in 2025, according to Morgan Stanley, businesses must be prepared to adapt to a more challenging economic environment. Deloitte forecasts 1.4% real GDP

By implementing strategies to mitigate risk and drive efficiency, a tech leader is better equipped to navigate economic uncertainty, regardless of the market climate.

Here are five core strategies to make your organization recession-proof.

Strengthen Financial Resilience

While the financial playbook is broad, these three practices offer high impact when a recession hits.

Scenario-based forecasting

Conduct regular forecasting sessions with finance, product, and sales leads to model base, optimistic, and downside scenarios reflecting fluctuations in economic activity. Ask:

- What spending can pause without jeopardizing delivery or compliance?

- What must continue to meet commitments and avoid downstream risks?

Scenario-based forecasting helps prioritize funding, protect critical paths, and identify trade-offs early and circumventing reactive cuts.

Flexible budgeting models

Use rolling forecasts or zero-based budgeting models to guide you as you adapt to the evolving economic situation. Shift from capital-intensive purchases to operational-expense-friendly service models like subscription-based services or cloud-based solutions.

In addition to the added flexibility and reduced upfront costs associated with opex, your business may also qualify for tax benefits associated with recurring operational expenses.

Strategic financial planning

Work with finance leadership to optimize costs and preserve liquidity, allowing for strategic pivots. For example, during a hiring freeze, have a plan to secure funding for external engineering capacity if demand surges.

Partner with a financial advisor to identify tax-advantaged expense structures, such as operational leases or cloud subscriptions. This partnership will also help safeguard access to credit and maintain robust working capital reserves.

By building financial resilience, organizations can adapt quickly to changing circumstances.

Retain and Develop Key Talent

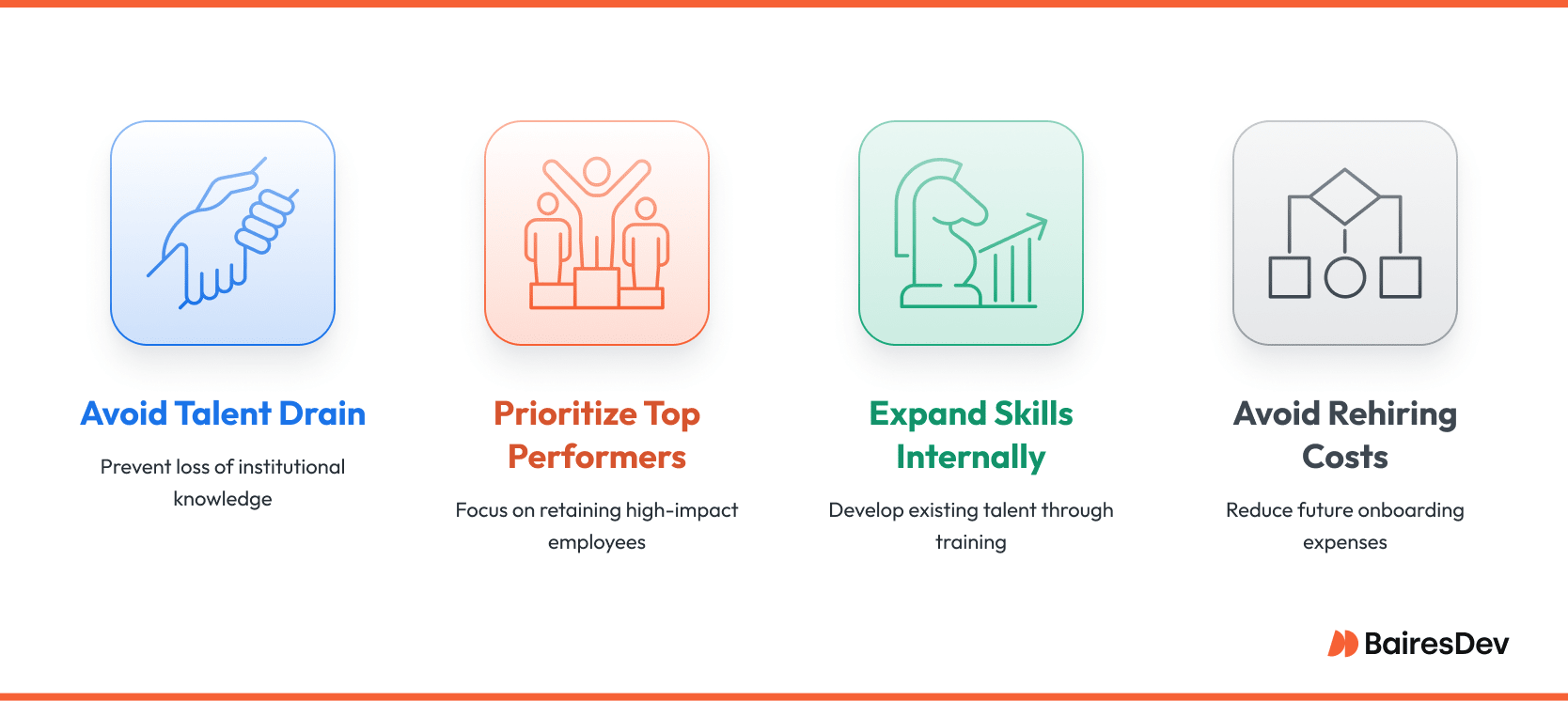

During economic recessions, companies often reduce costs by laying off staff or freezing backfill.

While these actions reduce payroll in the short term, they can degrade your ability to meet customer demand when the economy rebounds. Moreover, the loss of institutional knowledge can have lasting impacts that persist long after the economy recovers.

Rehiring and onboarding staff takes time and is expensive, so prioritize the retention of top performers. Invest in the professional development of engineers. Offer upskilling programs and opportunities for internal rotations.

By training engineers on adjacent systems, they can step in as needed. In this win-win scenario, the team’s flexibility and knowledge are strengthened, and the engineers benefit from enhanced job security and career growth opportunities.

Embrace Blended Resourcing

A rigid headcount model limits your team’s ability to respond to changing needs. To address this, leverage or expand your use of a blended resourcing model. This enables you to scale up or down without the overhead, lead time, or long-term commitment of full-time hiring.

For optimal outcomes, pre-vet trusted external partners that offer support services teams or professional services teams aligned with your time zone, communication, and delivery expectations.

Develop a Risk Planning Framework

Resilience isn’t about avoiding every risk. It’s about absorbing shocks without disrupting delivery. At least once a year, run structured planning scenarios with your leadership team. Model what happens if:

- Funding tightens

- Attrition spikes

- A key vendor exits

Work with stakeholders across finance, product, and procurement to create mitigation plans, or use external financial planning services. That includes vendor diversification, prioritization of key initiatives across budget tiers, and maintaining a small bench of flexible resources.

This cross-functional visibility ensures that if something breaks, you won’t scramble—you’ll already have a playbook.

Safeguard Strategic Initiatives

An economic downturn is no reason to stall high-priority programs. It’s a time to selectively continue spending where it matters most. Revenue-driving features, compliance-critical systems, and efforts to continue serving customers still need to move forward.

Protect these efforts by building in redundancy. That includes:

- Knowledge redundancy, where multiple team members are familiar with key systems.

- Partner and geographic diversification, so that a single failure doesn’t derail progress.

- Clear prioritization, where everyone knows what moves forward, even in lean times

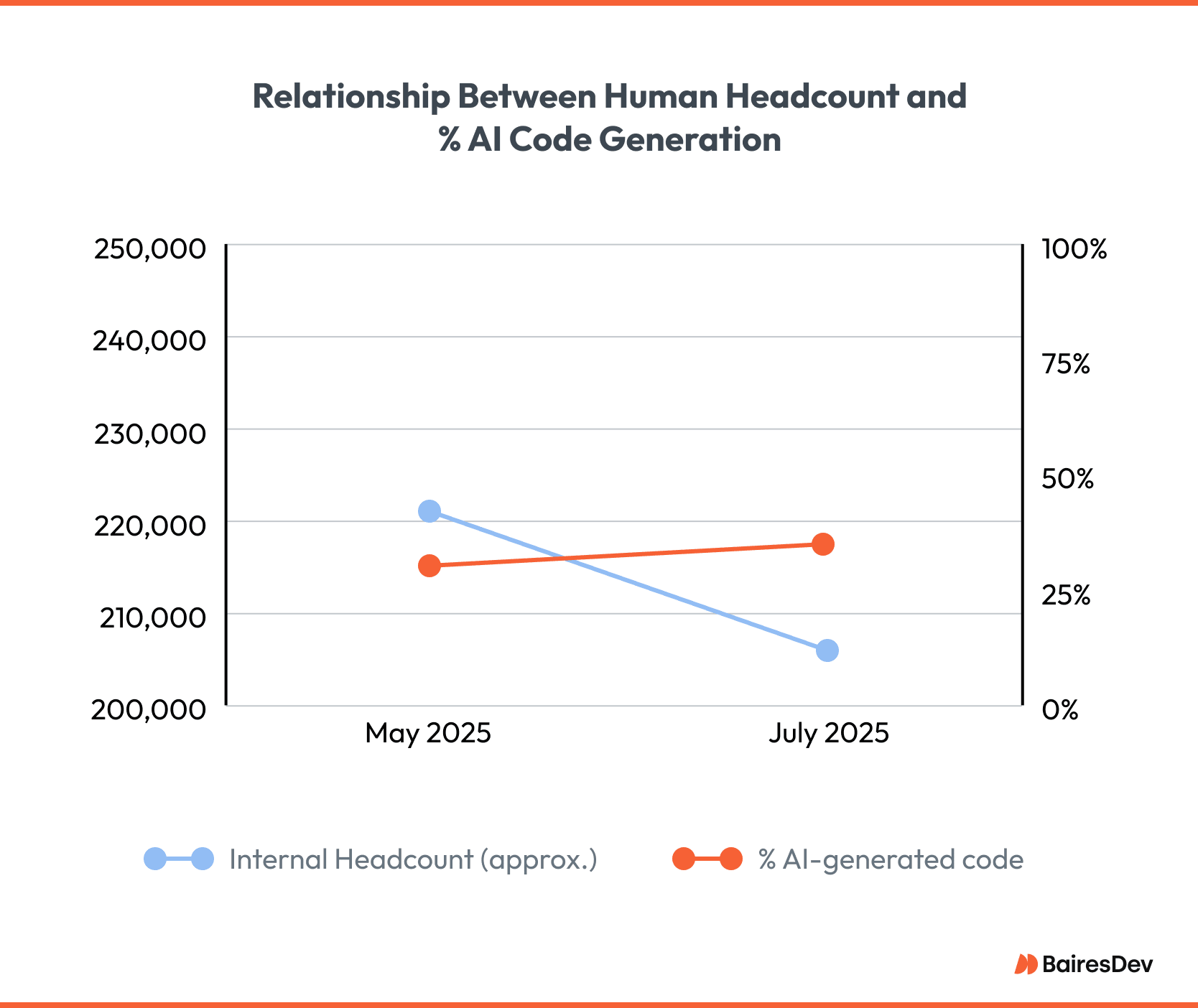

Case in point: Microsoft’s 2025 restructuring cut more than 15,000 roles—including engineering, sales, and support—to fund an $80 billion AI infrastructure shift. Despite the cuts, they preserved delivery momentum by automating 30-35% of code generation and streamlining support services with AI, reportedly saving over $500 million.

Rather than stall, they reallocated investment toward priority initiatives. This is a clear example of using automation and blended resourcing to maintain continuity during disruption without sacrificing strategic output.

Using Economic Downturns to Build Long-Term Advantage

While economic uncertainty can be a challenging time for businesses, it can also be a catalyst for growth, innovation, and new business ideas. Leaders who prepare for disruptions can position their organizations to not only weather the storm, but also capitalize on new opportunities.

By maintaining flexibility, prioritizing strategic initiatives, and staying agile, prepared leaders can leverage opportunities to build their enterprise.

Talent Acquisition

Economic downturns see slow hiring and mass layoffs across industries, creating an opportunity for you to step in and access high-caliber talent. These skilled professionals not only fill immediate gaps, but also help build long-term capacity. This keeps your business resilient and allows you to growth and capitalize on new opportunities as market conditions improve.

Strategic Project Acceleration

While small businesses often struggle to maintain velocity during downturns, enterprise tech leaders can use the moment to gain ground by doubling down on strategic initiatives. Economic slowdowns can offer a rare opportunity to focus on long-deferred technical priorities.

With fewer competing initiatives and less market-driven urgency, teams can redirect their attention to projects like architecture upgrades, platform refactoring, or automation rollouts. Advancing this foundational work during a downturn strengthens long-term efficiency and delivery readiness—giving organizations a head start when high demand rebounds.

Market and Tech Consolidation Prospects

Economic downturns often trigger slowdowns or cutbacks, but most businesses continue operating. A savvy leader can use these as opportunities to expand their organization’s market presence, acquiring undervalued technologies, absorbing capable teams, or simply outperforming peers in product delivery and support.

Leaders who act decisively in this climate can secure long-term gains and emerge from the downturn primed for expansion.

What Forward-Thinking Tech Leaders Prioritize

Budget pressures and market shifts are inevitable. Recession-resistant businesses maintain momentum through these challenges thanks to intentional strategy and disciplined execution.

Resilient organizations safeguard velocity, retain key talent, and sustain delivery excellence under pressure. This isn’t just risk management—it’s how operational leadership drives competitive advantage.

Frequently Asked Questions

How can engineering leaders maintain velocity during an economic recession-driven hiring freeze?

Tech leaders can incorporate flexible resourcing models that include pre-vetted external talent. When internal hiring slows, these vetted external teams can keep workstreams live, so velocity doesn’t drop. It also preserves delivery momentum even when internal hiring is paused.

What cost levers can tech execs pull without derailing delivery roadmaps?

Shift from capex-heavy investments to opex-friendly services to improve cash flow and preserve flexibility. Evaluate key programs by value, not volume. Prioritize must‑ship work, pause low-impact initiatives, and convert hard buys into flexible subscriptions.

How can external engineering partners help stabilize product output during economic uncertainty?

Geographically aligned partners offer stretch capacity on-demand without onboarding overhead or governance headaches. This cushions volatility while maintaining quality and throughput.

What risks do companies face if they delay investing in digital capabilities during an economic downturn?

Delaying strategic initiatives can lead to delivery gaps, falling behind competitors, and an inability to meet customer or compliance requirements. Investing in digital marketing and selling online capabilities, for instance, can provide cheaper alternatives and reach during periods when other businesses may be pulling back. Without proactive planning, the organization may lack the redundancy or capacity to adapt to shifting priorities.

How do you retain top engineering talent when budgets are tight?

Retention is supported by protecting core team members, offering cross-training and upskilling opportunities, and enabling lateral movement. Leaders who avoid reactive layoffs preserve institutional knowledge and maintain internal support services, reducing future rehiring costs. Talent preservation is particularly critical in sectors like healthcare that provide essential services and rely on institutional knowledge.

What’s the role of flexible resourcing (e.g., staff augmentation) in recession planning?

Flexible resourcing, including external support services, enables organizations to continue executing without the long-term commitment of full-time hiring. It helps absorb delivery volatility, respond to changing project loads, and maintain continuity without bloating fixed costs.